To be Gold IRA eligible, the gold must meet IRS fineness standards. It also requires an IRS-approved custodian.

Investing in a Gold IRA can diversify your retirement portfolio. Gold IRAs provide a hedge against inflation and economic instability. These accounts hold physical gold, such as bullion or coins, meeting specific IRS criteria. The gold must be at least 99.

5% pure and held by an approved custodian. This ensures security and compliance with tax regulations. Gold IRAs offer potential for long-term growth and financial security. Adding gold to your retirement plan can protect your investments from market volatility. Make sure to consult with financial experts before making any decisions.

Introduction To Gold Ira

Many people seek ways to secure their retirement. One effective method is through a Gold IRA. A Gold IRA is a unique retirement account. It allows you to invest in physical gold and other precious metals. This type of investment can diversify your retirement portfolio. It can also provide a hedge against inflation.

What Is A Gold Ira?

A Gold IRA is a self-directed individual retirement account. Unlike traditional IRAs, it allows you to hold physical gold. You can also invest in other precious metals, like silver and platinum. The IRS has specific rules for these accounts. They must be managed by a custodian. This ensures compliance with tax regulations.

Importance Of Gold Iras

Gold IRAs offer several benefits. First, they provide a hedge against inflation. As paper currency loses value, gold often retains its worth. Second, they offer diversification. Holding different types of investments reduces risk. Third, they provide a sense of security. Physical gold is a tangible asset. It can be stored and protected.

Consider these advantages when planning for your retirement. A Gold IRA can add stability to your portfolio. It can also ensure long-term financial health.

Eligibility Criteria

Understanding the eligibility criteria for a Gold IRA is crucial. This ensures your investments comply with IRS regulations. Let’s delve into the basic requirements and approved gold types.

Basic Requirements

To open a Gold IRA, you must meet some basic requirements. These include:

- Being at least 18 years old.

- Having earned income.

- Following IRS contribution limits.

It’s essential to use an IRS-approved custodian. This ensures your gold is stored safely and legally.

Approved Gold Types

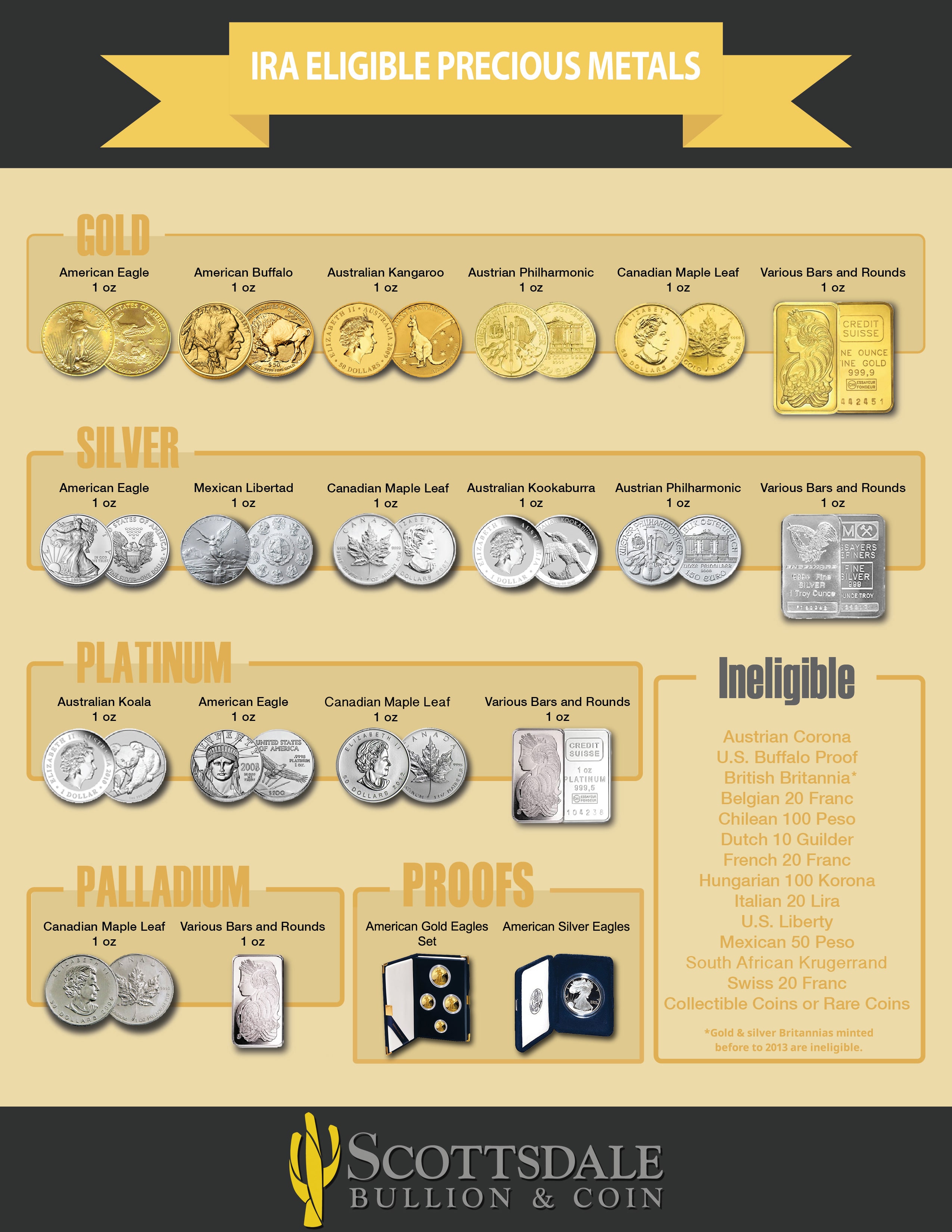

Not all gold is eligible for a Gold IRA. The IRS has specific approved gold types:

| Gold Type | Purity |

|---|---|

| Gold Bullion Bars | 99.5% purity |

| Gold Coins | 99.5% purity (except for the American Gold Eagle, which is 91.67%) |

Examples of approved coins include:

- American Gold Eagle

- Canadian Gold Maple Leaf

- Australian Gold Kangaroo

Ensure your gold meets these standards to be eligible for a Gold IRA.

Setting Up A Gold Ira

Investing in a Gold IRA can protect your retirement savings. Setting up a Gold IRA involves several steps. This guide will help you understand the process clearly.

Choosing A Custodian

First, you need to choose a custodian. A custodian manages your Gold IRA account. They handle the paperwork and ensure compliance with IRS regulations.

Not all custodians offer Gold IRAs. Look for a custodian with experience in precious metals. Check their fees and customer reviews. Make sure they have a good reputation.

Opening An Account

Once you choose a custodian, you can open an account. This process usually involves filling out forms. Provide your personal details and financial information.

Some custodians let you open an account online. Others may require a phone call or a meeting. Ensure you have all necessary documents ready.

Here is a simple checklist for opening an account:

- Choose a reputable custodian

- Fill out the application forms

- Provide personal and financial information

- Submit identification documents

| Step | Description |

|---|---|

| Choose Custodian | Find a custodian experienced with Gold IRAs. |

| Open Account | Fill forms and submit documents. |

Funding Your Gold Ira

Funding your Gold IRA is a crucial step in securing your retirement. There are several ways to do this. The most common methods include rollover options and direct transfers. Understanding these methods can help you choose the best path.

Rollover Options

Rollover options offer flexibility for your Gold IRA. You can transfer funds from an existing retirement account. This process is simple and involves a few steps.

- Contact your current IRA or 401(k) custodian.

- Request a distribution to your Gold IRA.

- Complete the rollover within 60 days.

Be cautious with the 60-day rule. Missing this deadline can lead to penalties and taxes. A trusted financial advisor can guide you through this process.

Direct Transfer

Direct transfers are another popular method for funding your Gold IRA. This method is straightforward and involves fewer steps.

| Step | Description |

|---|---|

| Step 1 | Contact your current IRA custodian. |

| Step 2 | Request a direct transfer to your Gold IRA. |

| Step 3 | Complete the transfer without handling funds. |

Direct transfers avoid the 60-day rule, reducing stress. This method is also free from penalties and taxes.

Both methods have their advantages. Consult a financial expert to determine the best option for you.

Purchasing Gold

Purchasing gold for a Gold IRA can be an exciting venture. It’s crucial to understand the specific requirements and steps involved. This section will guide you through the process of selecting gold products and finding approved dealers.

Selecting Gold Products

Not all gold products are eligible for a Gold IRA. The IRS has strict rules about the types of gold that can be included.

- Gold Bars: Must be produced by a reputable refiner.

- Gold Coins: Must be minted by national governments.

- Purity: Gold must have a minimum fineness of 0.995.

Here is a table of commonly accepted gold products:

| Product | Purity |

|---|---|

| American Gold Eagle | 0.9167 |

| Canadian Gold Maple Leaf | 0.9999 |

| Gold Bars | 0.999 |

Approved Dealers

Buying gold from an approved dealer is essential. The dealer must meet IRS standards for quality and authenticity.

- Research: Verify the dealer’s reputation and reviews.

- Certification: Ensure the dealer is certified by recognized associations.

- Documentation: The dealer should provide proof of authenticity and purity.

Finding a reliable dealer ensures your investment meets IRS requirements and safeguards your assets.

Storage Options

Understanding the storage options for a Gold IRA is crucial. It ensures your investment complies with IRS regulations. This section delves into the approved storage methods.

Irs-approved Depositories

The IRS mandates that Gold IRA assets be stored in approved depositories. These facilities meet strict security and management standards. They ensure your gold remains safe and compliant.

Here is a list of key features of IRS-approved depositories:

- High-level security systems

- Regular audits

- Insurance coverage

- Experienced staff

Popular IRS-approved depositories include:

- Delaware Depository

- Brinks Global Services

- HSBC Bank USA

Home Storage Rules

Gold IRAs cannot be stored at home. The IRS has strict rules against this practice. Home storage does not meet the security and management standards required.

Here are the main reasons why home storage is not allowed:

- Lack of security systems

- No regular audits

- No insurance coverage

- Risk of theft or loss

Choosing an IRS-approved depository ensures compliance. It also provides peace of mind. Your gold is in a secure, regulated environment.

Tax Advantages

Investing in a Gold IRA offers several tax advantages. These benefits can help you grow your wealth efficiently. Let’s explore the key tax benefits of a Gold IRA.

Tax-deferred Growth

One major advantage of a Gold IRA is tax-deferred growth. This means you don’t pay taxes on gains until you withdraw funds. Your investment grows without immediate tax impact.

Let’s break it down:

- No capital gains tax on annual profits.

- Allows for compounding of returns over time.

- Gains are taxed at withdrawal.

With tax-deferred growth, your money works harder for you. This can lead to significant savings over time.

Withdrawal Rules

The IRS sets specific withdrawal rules for Gold IRAs. Understanding these rules is crucial for maximizing benefits.

Here are the key points:

| Age | Withdrawal Rule |

|---|---|

| Before 59½ | 10% penalty + income tax on withdrawals. |

| After 59½ | No penalty, but income tax applies. |

| After 72 | Required Minimum Distributions (RMDs) start. |

Early withdrawals incur penalties and taxes. After age 59½, only income tax applies. At age 72, RMDs are mandatory.

By following these rules, you can avoid penalties. Plan your withdrawals wisely to get the most benefit.

Risks And Considerations

Investing in a Gold IRA can be a smart move. Yet, it comes with risks and considerations. Knowing these risks helps you make informed decisions.

Market Volatility

Gold prices can be unpredictable. They can rise and fall quickly. This volatility can impact your investment. During economic downturns, gold prices often increase. But they can also drop suddenly. Understanding this can help you prepare for market changes.

Scam Awareness

Gold IRA scams are a real threat. Some companies may offer fake gold or overpriced products. Be cautious and research before investing. Check reviews and verify the company’s legitimacy. It’s essential to protect your investment from fraud.

Consider these points to minimize risks:

- Choose a reputable company.

- Verify the purity of the gold.

- Understand the fees involved.

By being aware, you can invest wisely in your Gold IRA.

Frequently Asked Questions

What Is The Downside Of A Gold Ira?

Gold IRAs have higher fees compared to traditional IRAs. Storage and insurance costs can add up. Limited liquidity makes quick access difficult.

What Is The Difference Between An Ira And A Gold Ira?

An IRA is a retirement account holding stocks, bonds, and mutual funds. A gold IRA specifically holds physical gold or other precious metals.

How To Open A Gold Ira?

To open a gold IRA, select a custodian, fund the account, choose approved gold, and complete the required paperwork.

Can I Convert My Ira To A Gold Ira?

Yes, you can convert your IRA to a gold IRA. Contact a custodian specializing in precious metals IRAs.

Conclusion

Understanding gold IRA eligibility is crucial for smart investing. Ensure your gold meets IRS requirements. This helps secure your financial future. Always consult a financial advisor for personalized advice. With the right information, your gold IRA can be a valuable asset.

Stay informed and make wise investment choices.

Leave a Reply